Property Tax Rate Virginia . personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. 135 rows virginia : The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. Click here to read all about. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. Median property tax is $1,862.00. This interactive table ranks virginia's counties by median property tax in. real estate assessments & taxes. real estate tax rates. with an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Interested in knowing more about fairfax county taxes? Since home values in many parts of.

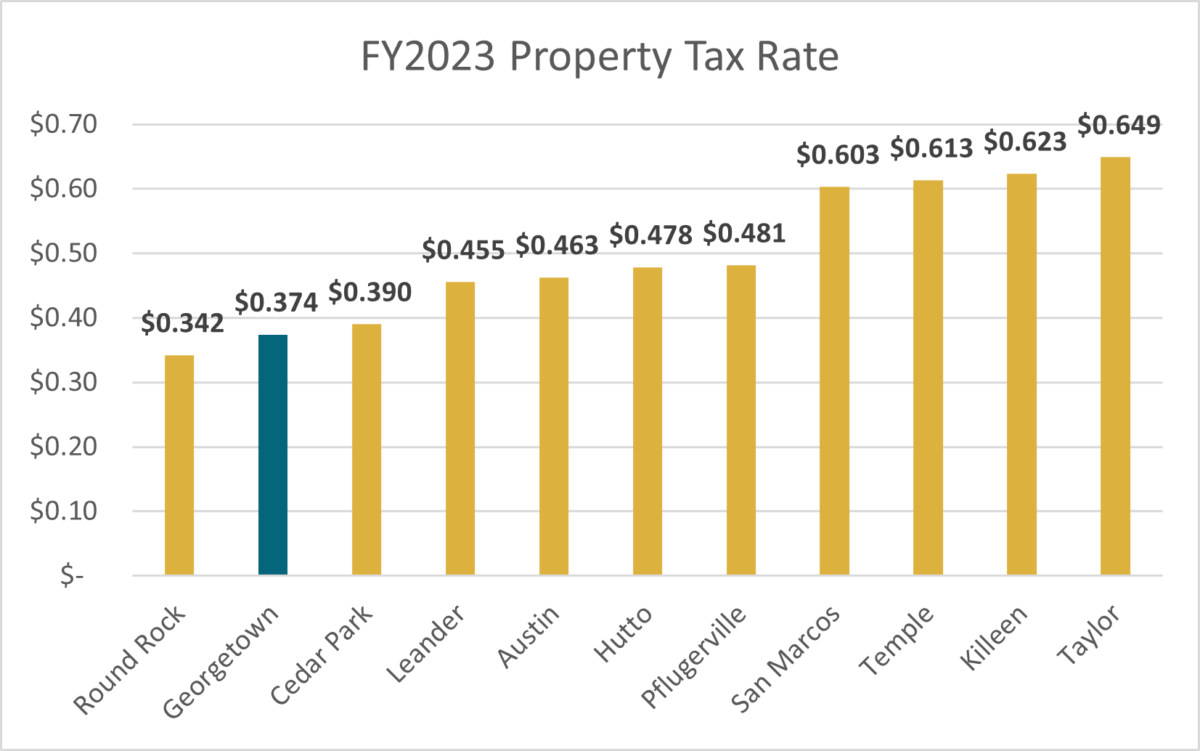

from finance.georgetown.org

Interested in knowing more about fairfax county taxes? with an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Median property tax is $1,862.00. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. real estate assessments & taxes. Click here to read all about. This interactive table ranks virginia's counties by median property tax in. Since home values in many parts of. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget.

Property Taxes Finance Department

Property Tax Rate Virginia Since home values in many parts of. real estate assessments & taxes. 135 rows virginia : Interested in knowing more about fairfax county taxes? This interactive table ranks virginia's counties by median property tax in. real estate tax rates. Since home values in many parts of. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. Median property tax is $1,862.00. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. with an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Click here to read all about. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate Virginia real estate assessments & taxes. with an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Median property tax is $1,862.00. Since home values in many parts of. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. tax's. Property Tax Rate Virginia.

From taxfoundation.org

State and Local Sales Tax Rates, Midyear 2021 Tax Foundation Property Tax Rate Virginia The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. Interested in knowing more about fairfax county taxes? 135 rows virginia : the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. tax's assessment/sales ratio study. Property Tax Rate Virginia.

From williamsburgsrealestate.com

Hampton Roads Property tax rates 20122013 Mr Williamsburg, Blogging Property Tax Rate Virginia real estate assessments & taxes. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. Click here to read all about. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. 135 rows virginia : Since. Property Tax Rate Virginia.

From cesugzjd.blob.core.windows.net

Essex County Va Property Tax Rate at Colin Kay blog Property Tax Rate Virginia Click here to read all about. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. real estate tax rates. Interested in knowing more about fairfax. Property Tax Rate Virginia.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Property Tax Rate Virginia Since home values in many parts of. real estate assessments & taxes. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. The rates shown below for tax year 2024. Property Tax Rate Virginia.

From www.yourathometeam.com

New Property Tax Rates Northern Virginia Property Tax Rate Virginia Median property tax is $1,862.00. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. Since home values in many parts of. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. Click here to read all about. 135 rows virginia :. Property Tax Rate Virginia.

From printableb2r3dji.z19.web.core.windows.net

Va State Taxes 2020 Property Tax Rate Virginia real estate assessments & taxes. Median property tax is $1,862.00. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. This interactive table ranks virginia's counties by median property tax in. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment. Property Tax Rate Virginia.

From learningschoolluchaku4.z4.web.core.windows.net

Pay Virginia State Estimated Taxes Online Property Tax Rate Virginia Interested in knowing more about fairfax county taxes? 135 rows virginia : real estate tax rates. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective. Property Tax Rate Virginia.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax Rate Virginia real estate assessments & taxes. with an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Since home values in many parts of. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. 135 rows virginia :. Property Tax Rate Virginia.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate Virginia tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. Since home values in many parts of. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. Click here to read all about. the median property tax in virginia is. Property Tax Rate Virginia.

From www.ezhomesearch.com

EZ Home Search Guide to Virginia Property Taxes Property Tax Rate Virginia tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. Interested in knowing more about fairfax county taxes? Click here to read all about. This interactive table ranks virginia's counties by median property tax in. real estate assessments & taxes. the median property tax in virginia is $1,862.00 per. Property Tax Rate Virginia.

From www.s-ehrlich.com

When Are Fairfax County Real Estate Taxes Due SEhrlich Property Tax Rate Virginia Since home values in many parts of. tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. Click here to read all about. Median property tax is $1,862.00. Interested in knowing more about fairfax county taxes? the median property tax in virginia is $1,862.00 per year, based on a median. Property Tax Rate Virginia.

From varabetsubu.blogspot.com

Va Va Tax Rate Property Tax Rate Virginia tax's assessment/sales ratio study estimates effective rates of real estate by controlling for the variance in assessment procedures. real estate tax rates. Median property tax is $1,862.00. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. the median property tax in virginia is $1,862.00 per year, based on. Property Tax Rate Virginia.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Property Tax Rate Virginia The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. real estate assessments & taxes. This interactive table ranks virginia's counties by median property tax in. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. Click here to read all. Property Tax Rate Virginia.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate Virginia Interested in knowing more about fairfax county taxes? The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. Since home values in many parts of. the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. with an. Property Tax Rate Virginia.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate Virginia real estate tax rates. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. The rates shown below for tax year 2024 are the approved rates from the fy 2025 adopted budget. with an average effective property tax rate of 0.75%, virginia property taxes come in well below. Property Tax Rate Virginia.

From eyeonhousing.org

Property Taxes by State 2016 Property Tax Rate Virginia real estate tax rates. Median property tax is $1,862.00. This interactive table ranks virginia's counties by median property tax in. 135 rows virginia : the median property tax in virginia is $1,862.00 per year, based on a median home value of $252,600.00 and a median effective property. tax's assessment/sales ratio study estimates effective rates of real. Property Tax Rate Virginia.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rate Virginia Click here to read all about. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns. Since home values in many parts of. with an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Interested in knowing more about. Property Tax Rate Virginia.